2015 Grandma Rie’s Money Camp Activities and Resources

Teaching the next generation to successfully handle money and personal finances is normally a family responsibility. Although parents bear much of the burden to teach, train and model good personal finance, extended family members can also contribute.

Although my grown children do very well in the personal finance arena, they learned from us by osmosis, without any special or formal training by my spouse or I. When they presented me with grandchildren, I vowed that I would take an active part in teaching financial literacy to them.

As a result, I started a one week ‘Grandma Rie’s Money Camp’ in 2011 and held our fifth annual one this year.

Hiccups in this years plan.

My plans for this years camp were quite extensive. The grandkids are reaching the tween and near tween stage and have a greater capacity to soak up some of the information. I spent quite a while developing the plans for camp, but then, as usual, things changed and I had to be nimble in tailoring the plans to reality.

We like to hold camp at our lake condo – to combine learning with fun. I usually get the condo reserved for the two weekends surrounding our 5 day camp so we can get there over a weekend, get settled in and then have a weekend to wrap up afterwards, plus have time to go do some activities in our resort area.

This year, however, parents plans were in flux and I didn’t nail the Money Camp dates until later than usual. The condo was already reserved for the weekend prior. Also, I had to drive a couple hundred miles to pick up the kids and take them to the condo, instead of their parents being able to deliver them to me.

I was thrilled when ‘the other grandma’ accepted my invitation to help out with camp again this year. Since I was already in the area, it wasn’t a problem to add her to the car ride down. Unfortunately, she had to work late into the afternoon so we got a late start on the 5 hour drive and ended up at the condo way past the kids bed times.

I had planned the camp to begin at 9 AM each day, but the first day we all overslept. I hurried up and reviewed the schedule to see what to cut that day. Because my co-host slept on the sofa sleeper in the living room, and had trouble sleeping, it was hard for her to get up in time for the 9 AM camp start, so most days were shorter than intended.

But, it was well worth the shortened up days to have a willing and able adult to help out and assist in getting the kids engaged in the program.

In prior years I tried to craft the schedule to alternate passive and active learning but I had a harder time with that this year. We used a lot of videos and books this year, which are definitely passive activities. But, I lucked out as the kids were at an age where they didn’t mind watching and listening to the stories.

The only other disappointment was that the kids decided not to engage in an ongoing business. I presented the idea of making and selling Christmas treats and crafts to family members, with us making samples and brochures and such for it during camp and then getting back together in December to fill any orders we got. I gave the kids a choice – we could do the Christmas treat business (also selling some of the treats at their normal Money Camp stand) or they could just do the normal Money Camp business during camp. They both chose just to do the business during camp only.

Learning modules and resources.

This year, we started camp off by pursuing learning about saving and investing, practical money skills (like making change, paying taxes, and budgeting).

We watched a lot of Biz Kids shows – which were entertaining and educational and held the kids interest. They have one on saving and investing as well as one on budgeting which we watched. Each is half an hour. Sometimes you can find these on You Tube.

I made up a scavenger hunt for them to play. I picked logos of companies for items we have in the condo and made up a table of about 15 for them to find.

When they finished, we looked up a couple of the logos to see what company it belonged to and whether or not the company sold stock to the public. If it did, we looked up the stock prices online. This got real interesting to the older boy when he found that one of the logos was used by Hasbro. He has one share of Hasbro and got excited when he saw how much it was selling for. We ended up looking it up several times over the course of the week.

We also read Once Upon a Company as part of this unit. It is a story about how kids saved for college by making and selling holiday wreaths.

I found a board game called Presto Changeo which reinforces making change. The game calls for participants to count back the change the old fashioned way – instead of relying on a computer to tell how much to give back.

For the budgeting lesson, we once again played a lets pretend game – where they are the grownups and have to make their monthly salary last all month.

We explored how other tweens are making money and how they go about it.

As part of that, we watch some You Tube videos showing how some of their peers are making money. Here are a couple we used:

- Thomas Suarez: A 12-year-old app developer on TED

- 8-Year-Old Kid Makes $1.3 Million A Year With His Viral YouTube Videos

We also watched some how to vids on things like dog walking and babysitting:

This year we moved away from picture books and started chapter books for reading out loud. I had planned on doing two, but we only had time for Toothpaste Millionaire. It is about a couple of kids who start making toothpaste and end up with a million dollar company.

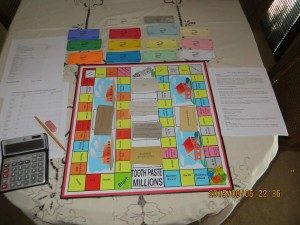

To go along with that, I spent many hours developing my own board game – which I named Toothpaste Millions.

We played it for an hour, but I will use it again in future camps as well.

We played it for an hour, but I will use it again in future camps as well.

It reinforces the ideas that the decisions you make determine your path. It shows the difference between a start up business and a full fledged enterprise. It also forces practice in math with large numbers and helps players understand that there are risks.

If you are interested let me know and I may be able to provide you with a free print and play version.

I introduced them to negotiation and sales techniques.

These we will no doubt cover again in future years as well.

Once again, we watched Biz Kids episodes, one about negotiating and one called Sell, Sell, Sell!

Afterwards we looked at a presentation that showed when you have to sell (almost every situation can involve selling) and role played in teams to practice selling to each other.

Our negotiation day was interrupted by a pleasant happening. A friend had indicated they might be able to give us all a boat ride on the lake in their new boat. I didn’t plan for it, not knowing if it would happen or not, but we got to go! Part of Grandma Rie’s Money Camp is all about building relationships and memories with the grandkids and this fit the bill perfectly. It was one of our main ‘fun things to do’ this year at camp.

Hopefully this post has given you some ideas on things you might do or use to help your kids or grandkids become more financially literate.